Photo by Lennert Naessens on Unsplash

I recently saw a chart that really struck home. We will get to this, but it’s worth looking at an interesting trend that has emerged in the world post-Covid.

It seems that now, it's all about the supply of money rather than the cost. This shift has significant implications for both opportunities and risks in the market.

It really is fascinating to see how global liquidity (the supply of fiat currency across the major countries) and the price of Bitcoin are connected.

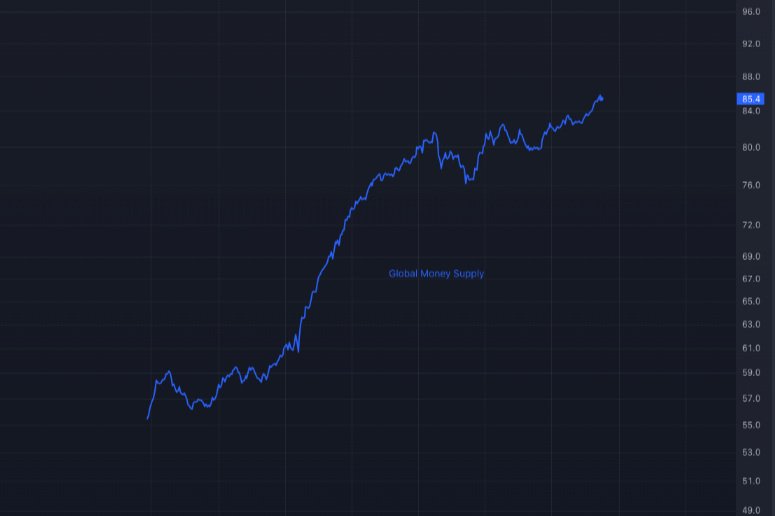

Chart 1 - Global Currency Stock

TradingView: Calculation includes major currencies (USD, EUR, CNY, GBP, JPY)

Notice the “massive” expansion in money stock globally since 2019, almost doubling in the last 5 years.

Chart 2 - Bitcoin (Logarithmic)

TradingView: Bitcoin (2018 - present)

From the above chart of Bitcoin

“It's evident that the price of bitcoin tends to go up when Global M2 grows”

This correlation highlights the influence that liquidity has on the Bitcoin market. Changes in M2 growth can have a substantial effect on not just Bitcoin but also stocks and other investments, demonstrating the interconnectedness of the financial markets with global liquidity.

Comparing global liquidity and the Bitcoin price, we can see that bitcoin is highly sensitive to changes in M2 compared to other assets. This sensitivity suggests that as global liquidity continues to increase in the next few years, we might witness significant price spikes in the price of Bitcoin.

“The outlook for the future price of bitcoin appears promising.”

With the expectation of continued liquidity growth over the next 9 to 36 months, it bodes well for sound money investors and enthusiasts alike.

DISCLAIMER

This publication is general in nature and is not intended to constitute any professional advice or an offer or solicitation to buy or sell any financial or investment products. You should seek separate professional advice before taking any action in relation to the matters dealt with in this publication. Please also note our disclosure here